Major U.S. Bank Customers Lose Life Savings in Widespread Financial Scam

Beware: TD Bank Text Scam Steals Savings via Fake Alerts

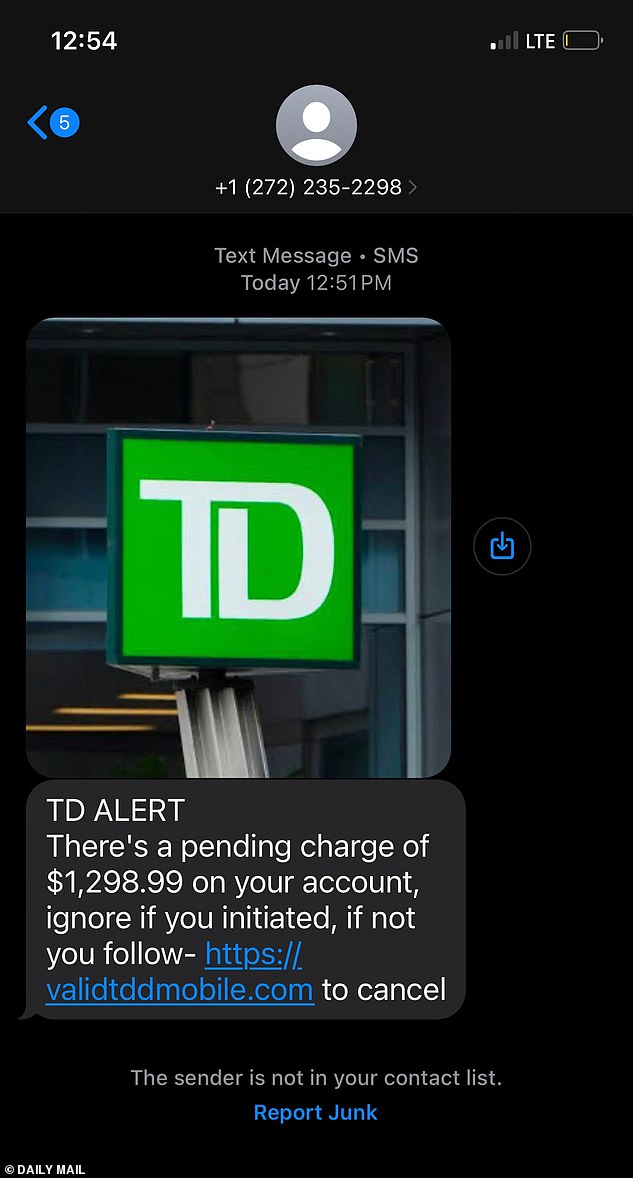

Cybercriminals are impersonating TD Bank in a sophisticated "SMShing" scam, tricking victims into surrendering their login credentials and draining their accounts. The scheme involves texts claiming unauthorized charges, complete with the bank’s logo and urgent language.

How the Scam Works

Fraudulent messages, like one received by DailyMail.com, state: “TD Alert. There’s a pending charge of $1,298.99 on your account. Ignore if you initiated; if not, follow https://www.dailymail.co.uk/sciencetech/article-14474399/TD-Bank-scam-text-message-savings.html?ns_mchannel=rss&ns_campaign=1490&ito=1490.” The link directs users to a convincing fake TD Bank login page (e.g., validtddmobile.com), where entering usernames/passwords hands hackers full account access.

[Image: Scam text example with TD Bank logo and fake charge alert. Caption: Fraudulent text urges users to click a link for a "pending charge."]

Red Flags to Spot

While the fake site mimics TD’s official portal, it lacks critical details like the FDIC insurance disclaimer. TD Bank warns customers to verify URLs and never share passwords, even if requests appear legitimate.

Martha Gaston, TD Bank spokesperson, emphasized vigilance: “Avoid sharing sensitive info. Legitimate institutions won’t ask for passwords via text.”

[Image: Fake TD Bank login page. Caption: Fraudulent site mirrors TD’s design but omits FDIC protections.]

Rising Threat of Financial Fraud

Bankrate’s March 2024 survey reveals alarming trends:

- 34% of U.S. adults faced financial fraud since January.

- 37% lost money, often through stolen credentials (19%) or fake payments (23%).

Sarah Foster, Bankrate analyst, notes scams have evolved: “They’re no longer just obvious typos—fraudsters use fear and polished tactics.”

What to Do If Targeted

- Don’t click links in unsolicited texts.

- Verify charges via official TD app or customer service.

- Lock cards and alert TD immediately if compromised.

Protect Yourself

- Enable two-factor authentication.

- Monitor accounts for unusual activity.

- Report scams to the FTC and local authorities.

TD Bank and the American Banking Association stress that vigilance is key to thwarting these increasingly sophisticated attacks.

Stay informed, stay skeptical, and protect your financial data.

(Word count: ~600)